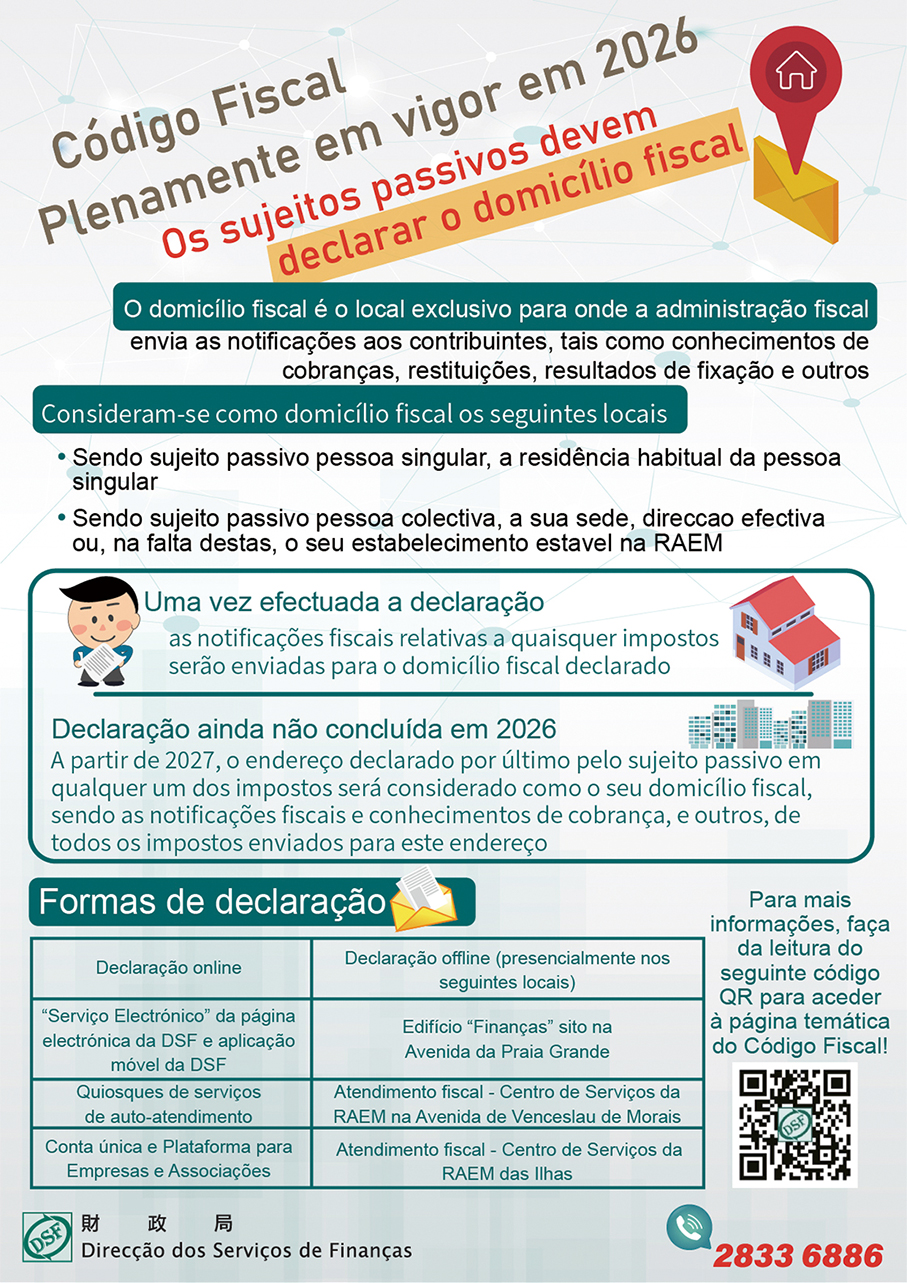

The Financial Services Bureau (DSF) announced in a statement yesterday that in accordance with the implementation of the new Tax Code, taxpayers are required by law to register their tax domicile with the bureau between January 1 and December 31 this year.

The tax domicile serves as the sole address to which the bureau will send official notifications to taxpayers, including payment notices, refunds, assessment results, and other related documents, the statement said.

For taxpayers, according to the statement, their habitual residence is recognised as the tax domicile. For corporate taxpayers, their registered office, actual place of management, or in the absence of these, the seat of their permanent establishment in Macau is considered the tax domicile, the statement said.

The statement pointed out that if taxpayers are simultaneously liable for multiple types of taxes, they are only required to submit a single declaration of their tax domicile, in which case all tax-related notifications for any taxes will be sent to the declared tax domicile.

The statement also said that if the declaration of the tax domicile is not completed this year, starting in 2027, the most recent address provided by the taxpayer for any tax purpose will be considered the tax domicile. All tax notifications, payment notices, and other related documents for all taxes will then be sent to that address, the statement said.

Taxpayers, according to the statement, can submit the declaration online via the “Electronic Service” on the website of the bureau, DSF’s mobile application, Macao One Account, and the Business & Associations Platform. The statement also said that taxpayers may submit it in person by visiting tax service counters located at the DSF headquarters on Avenida da Praia Grande, the Government Service Centre in Areia Preta, or the Government Service Centre on Rua de Coimbra in Taipa, to submit the declaration form.

This poster provided by the Financial Services Bureau (DSF) yesterday shows that taxpayers need to declare their tax domicile this year.